Technical Analysis

This is the 4-hour chart of BTC/USD captured at 9:00 AM on 05/06/2025. Based on the chart, we can observe the following:

Current Situation:

- The current price is approximately 94,155.8 USD, down 539.8 USD (-0.57%).

- The price reached a peak of around 97,000 USD before declining, indicating selling pressure.

- RSI (14) is at 42.19, near the neutral zone but slightly leaning toward a decline, suggesting weakening upward momentum.

- The EMA 20 (94,657.4) and EMA 50 (94,901.5) are above the current price, creating short-term resistance.

- The "Bear" signal from RSI suggests a potential price drop in the short term.

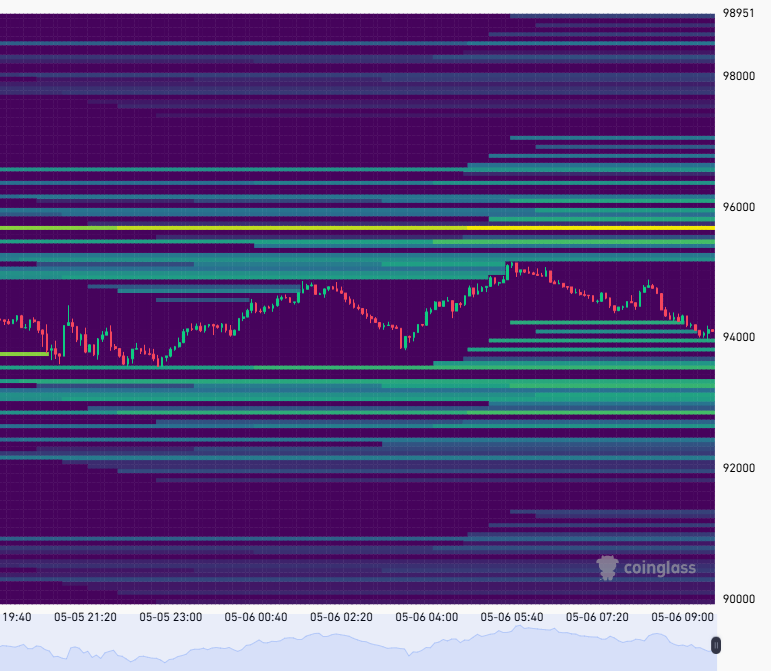

BTC Liquidation Map on 05/06/2025

Bitcoin Market Cap Ratio — BTC.D (DOM) Chart

Trend for the Next 3 Days

- Support: The price may test the 92,901.5 (EMA 200) level or drop lower to 90,263.4 if selling pressure increases.

- Resistance: If the price recovers, the 94,657.4 (EMA 20) and 94,901.5 (EMA 50) levels will be the first barriers, followed by 97,000 USD.

- With RSI declining and the price below short-term moving averages, the trend over the next 3 days is likely to lean toward a decline or sideways movement, unless strong buying pressure pushes the price above EMA 50.

News and Onchain

Some news that may impact BTC's price:

- Report on the U.S. Strategic Bitcoin Reserve: Today is the deadline for the U.S. Treasury to release an important report on creating a Bitcoin reserve from seized assets, per Trump's executive order. This could cause significant volatility due to expectations of approval or rejection by the government, affecting market sentiment.

- Stablecoin and Crypto Market Structure Legislation: There are draft laws in the U.S. regarding the legal framework for stablecoins and the crypto market, which could attract institutional capital if passed, creating upward pressure or strong volatility.

- ETF Activity and Institutional Demand: Demand from Bitcoin ETFs is rising, along with major companies like Microstrategy and Twenty One Capital (holding 42,000 BTC) accumulating Bitcoin, which could support the price if the trend continues.

- Macroeconomic Conditions: Economic data such as negative GDP and weak job reports (ADP) recently may drive investors to BTC as a safe-haven asset, although pressure from tariffs and interest rates is also a factor to watch.

Conclusion: Based on the technical analysis and the news and onchain data, my personal opinion is that the short-term trend for BTC may decline, potentially pulling the entire market down. However, if better news emerges, it could push BTC's price back up to around 96k.

Note: This is only a personal analysis and not investment advice; you are responsible for your own decisions.